The groups state that they want the CFPB to: Outside of eliminating the DTI ratio requirement and the associated Appendix Q, the group does not believe any other changes to the QM rule are necessary. “Allowing for this flexibility will ensure that lower-income borrowers and minorities are better able to participate in the home-buying process, without introducing undue risk to the system.” Instead, we should focus on alternatives, like permitting the use of compensating factors or implementing a residual income test,” Broeksmit wrote. “With respect to the 43% DTI threshold, it makes little sense to commit to a rigid requirement that does not account for the complexities of underwriting.

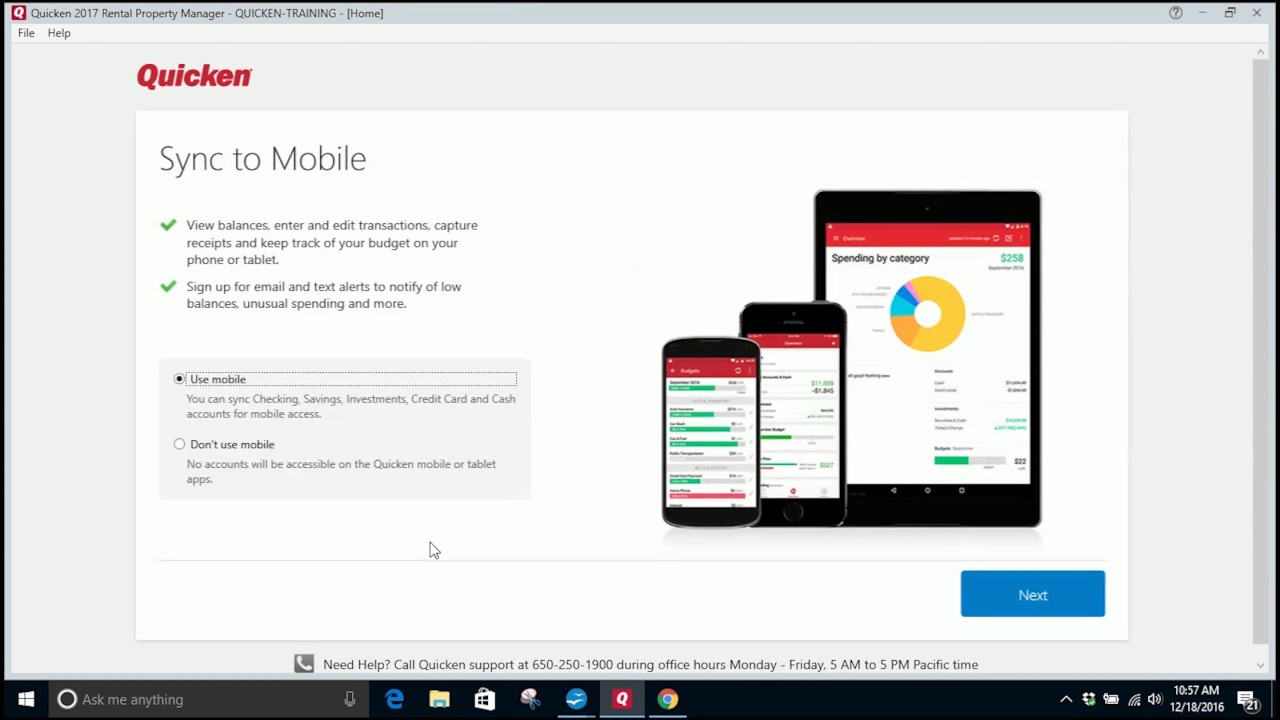

#When does quicken 2017 expire Patch

But lending outside of the Patch and the Federal Housing Administration channel has been limited largely because of the difficulty of complying with QM’s hard DTI cap and the related requirements of Appendix Q, while the Patch has provided the regulatory certainty that was far more attractive to lenders.Īfter the Patch expires, the best way to enable fair market competition across all lending channels while also ensuring that these creditworthy individuals can be served in a safe and sound manner under the existing ATR-QM framework is to eliminate the DTI ratio for prime and near-prime loans and with it Appendix Q.Īs MBA President and CEO Robert Broeksmit recently argued in an article for HousingWire’s Pulse, there may be alternative methods for determining a borrower’s creditworthiness beyond a strict DTI metric. Moreover, analysts estimate that roughly $260 billion (within a range of $200-320 billion) of 2018 total mortgage loan origination volume met the QM definition under the GSE Patch. The GSE Patch has facilitated access to homeownership for approximately 3.3 million creditworthy borrowers who collectively represent nearly 20 percent of the loans guaranteed by the GSEs over the last 5 years. The GSE Patch has provided an alternative to the DTI ratio threshold, as well as relief from the rigid requirements for verifying and calculating income, assets, and debts for DTI ratios under Appendix Q for non-W-2 wage earners.

And the group believes that removing the DTI cap will allow for a responsible expansion of lending practices. This week, Wells Fargo, Bank of America, Quicken Loans, and Caliber Home Loans joined with the Mortgage Bankers Association, the American Bankers Association, the National Fair Housing Alliance, and others to send a letter to the CFPB, asking the bureau to eliminate the 43% DTI cap on “prime and near-prime loans.”Īs the group states, a recent analysis by CoreLogic’s Pete Carroll showed that the QM patch accounted for 16% of all mortgage originations in 2018, comprising $260 billion in loans.īut the group notes that the QM Patch (or GSE Patch, as they groups refer to it as in their letter) has limited borrowers’ options for getting a mortgage.

Under the QM Patch, loans sold to Fannie or Freddie are allowed to exceed to the 43% DTI ratio.īut some in the mortgage industry, including Federal Housing Finance Agency Director Mark Calabria, believe that the QM Patch gave Fannie and Freddie an unfair advantage because loans sold to them did not have to play by the same rules as loans backed by private capital.īut the QM Patch is due to expire in 2021, and earlier this year, the CFPB moved to officially do away with the QM Patch on its stated expiration date.Īnd now, a group of four of the 10 largest lenders in the country are joining with some sizable trade and special interest groups to call on the CFPB to make changes to the QM rule in conjunction with allowing the QM Patch to expire.

#When does quicken 2017 expire mac

The rule also includes a stipulation that a borrower’s monthly debt-to-income ratio cannot exceed 43%, but that condition does not apply to loans backed by the government ( Federal Housing Administration, Department of Veterans Affairs, or Department of Agriculture).Īdditionally, Fannie Mae and Freddie Mac are not bound this requirement either, a condition known as the QM Patch. The Ability to Repay/Qualified Mortgage rule was enacted by the CFPB after the financial crisis and requires lenders to verify a borrower’s ability to repay the mortgage before lending them the money. Specifically, the group, which includes Bank of America, Quicken Loans, Wells Fargo, and Caliber Home Loans, wants the CFPB to do away with the QM rule’s debt-to-income ratio requirement. Four of the largest mortgage lenders in the country are leading a coalition that is calling on the Consumer Financial Protection Bureau to make to changes to the Ability to Repay/Qualified Mortgage rule.

0 kommentar(er)

0 kommentar(er)